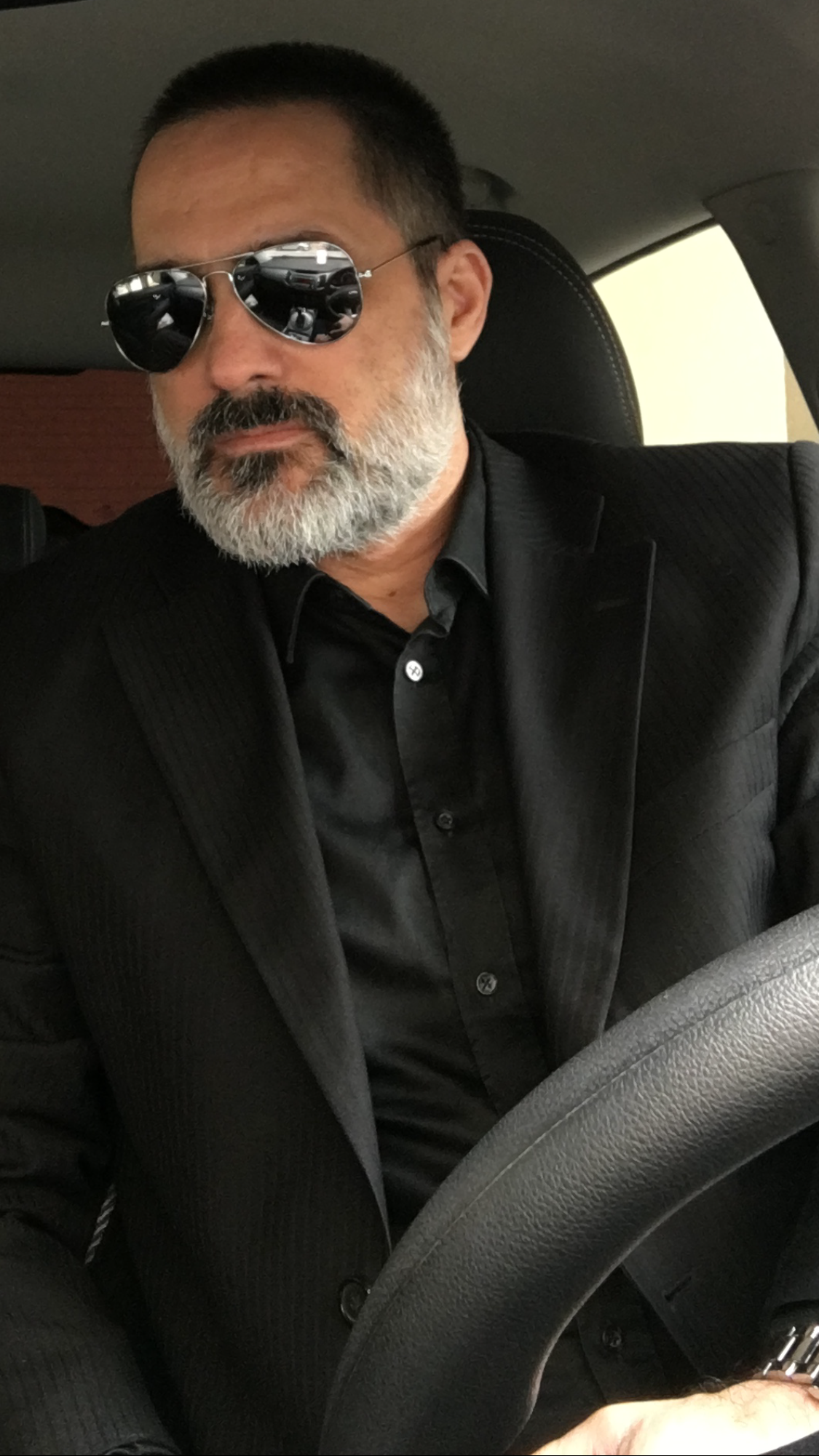

The name is Balmer. Dan Balmer.

The new president of Middle East business for Aston Martin Lagonda, the iconic British car maker beloved by James Bond, is grateful for the glamorous legacy of the fictional super-spy, but also conscious of the need to move on.

“We’ve been with Bond for 50 years, and he has been a real asset for us. But we have a team internally called ‘Beyond Bond.’ If we want to grow the brand audience, into the family and female markets, we have to look beyond the cars that Bond drives,” said Balmer.

That move away from some aspects of Aston’s heritage is reflected across the whole company. Aston has been around for more than 100 years, but has embarked on an ambitious “second-century strategy” under group CEO Andy Palmer.

The company that is emerging will be different, a luxury brand rather than a mere maker of fast boys’ toys; it will be increasingly global, with the Middle East playing a central role; and it will — hopefully — be sustainable, in both a financial and environmental sense.

British actor Roger Moore stands beside an Aston Martin car during a ‘James Bond photocall’ at Bletchley Park in Milton Keynes, on October 17, 2008. (AFP)

Palmer’s strategy is to steer the group away from the boom-and-bust cycle — it went bankrupt seven times in its first century. He pulled off an essential part of that strategy with an initial public offering (IPO) on the London Stock Exchange last month, which valued the company at $5.6 billion.

Aston will continue to make fast cars, but they will increasingly be more fuel efficient and even electric; and it will put its name to other luxury merchandise — plans for apartments and speed boats are well advanced. Next on the luxury list of Aston-branded items are submarines and vertical take-off aircraft.

Bond, with his love of both the high life and high-tech gadgetry, would probably approve of the strategy. “We’re not hawking the brand around — you won’t see us doing aftershaves and umbrellas. But customers want to buy our cars because they want to buy into beauty, and we’re stretching that now into other areas,” Balmer said.

——-

BIO:

BORN

1976 Southampton, UK.

EDUCATION

Design technician apprentice, Rover Group.

CAREER

•BMW design engineer.

•Rolls-Royce Motor Cars, general manager in Asia-Pacific.

•Aston Martin Lagonda, president for the UK andSouth Africa.

•Aston Martin Lagonda, president for the Middle East, North Africa and Turkey.

——-

He knows a thing or two about luxury marketing and car design, having previously worked for Rolls-Royce in Asia, based out of Singapore. But now the challenge is to extend the Aston business in the Middle East in a new division within the global set up — covering the Middle East, North Africa and Turkey (MENAT).

Reflecting Aston’s traditional regional business hub in the region, he will be based in the UAE, but the headquarters has been moved from Dubai to Abu Dhabi, where the MENAT HQ was officially inaugurated last week.

Balmer feels that Dubai’s reputation for flash glamor is “a thing of the past,” but also believes that the UAE capital is more in tune with the Aston image. “Aston has an understated elegance and that is also how we feel about Abu Dhabi. It is the capital, recognized as the center of the financial scene, the big decisions are made here, and with Yas Island (the venue for the big Formula 1 Grand Prix later this month) it is a great location for motor sports.”

The Aston Martin DB10, built exclusively for the James Bond film “Spectre,” is displayed at the 2015 Los Angeles Auto Show in Los Angeles, California, November 19, 2015. (AFP)

Track racing is still a big thing for Aston, not least because many of its cars are too fast to be driven flat out on roads, but also because it helps the company maintain its high-speed image against competitors such as Ferrari and Lamborghini, the UAE’s sports cars of choice.

Under the second-century strategy, Aston can offer the DB11, the DBS (“a boot in a suit” says Balmer), the Vantage and the Valkyrie as its “overtly aggressive” cars to rival the Italians, and will also soon begin to produce a range of mid-engined cars to take on the likes of Porsche and Mercedes.

Saudi Arabia is big on collectors’ cars, like our Vulcan. But we need to grow the brand.

“We are breaking out of our conservative shell. These are track-based products, but meant to be driven on the road, true sports cars,” Balmer said.

But the really radical product is yet to come, and will figure prominently on Middle East roads when it arrives, some time in 2020. Aston has hitherto held off entering the SUV market, which is the fastest-growing sector in the world’s biggest markets, like the US and China.

The DBX is a luxury SUV, a bit bigger than most on the roads now, with five doors and elegant lines. It is aimed at the upmarket family market, and seems a natural fit for the Middle East, which has been SUV-crazy for decades.

Balmer thinks it will become Aston’s biggest seller in the region. “We just have not had the offering in that segment before, but in the Middle East a majority of luxury car buyers would be SUV, with sports cars a weekend plaything,” he said.

In this file photo, an Aston Martin DB5 is displayed as part of an exhibition dedicated to James Bond at the main hall of La Vilette in Paris. (AFP)

He is relishing the prospect of unleashing the DBX on Saudi Arabia. Aston has been in the Kingdom a long time, with a long-standing partner the Hajji Husein Alireza group and showrooms in Jeddah and (more recently) Riyadh, to be followed by an outlet in Alkhobar.

But Saudi Arabia has not lived up to the potential of its big wealthy population. It ranks behind the UAE, Kuwait and Qatar, roughly alongside Turkey in Aston’s regional sales rankings.

“Saudi Arabia has more opportunity for us. Because of the sheer weight of wealthy individuals it means there are more people who will buy our cars there. Saudi Arabia is big on collectors’ cars, like our Vulcan, and the other beautiful cars we produce like Vanquish and DBS. But we need to grow the brand,” Balmer said.

A momentous day in Aston Martin’s 105-year history #AstonMartinLagonda pic.twitter.com/zKw4644Y09

— Aston Martin (@astonmartin) October 3, 2018

“We need to do an education job in Saudi Arabia, both in terms of what Aston stands for in the market and the new products as well. I think Saudis will go for the idea of DBX, and that’s where the key focus will be for us.”

He believes the Saudi market is perhaps more conservative than the UAE in terms of colors and models, but there is potentially a far bigger market among Saudi nationals than Emiratis.

Saudis buy Rolls-Royce cars in big numbers, and having worked for the leader in motoring luxury Balmer appreciates the difference between marketing Rolls and Aston. “They differ in the customer type. Aston buyers tend to be really into their cars. They are ‘petrol heads’ but also discerning.

“Rolls customers know their cars too, and might have an Aston in the garage as well, but they’re buying a Rolls-Royce as more a statement purpose — for business use, or a reward in life. An Aston is more a purchase of emotion and desire,” he said. Whether as a reward or out of emotion, buying an Aston is a considerable outlay. The average price ticket is around $175,000, and such an impulse purchase could easily be put off if personal economic circumstances took a downturn.

In the Middle East, where economies are tied to the oil price, that makes Aston subject to the vagaries of the global crude market. “What’s happening in the region is that governments are diversifying away from oil. (Saudi Arabia’s reform program) Vision 2030, for example, is a big change and good news for us. It will eventually take the volatility away from the macro economic environment. But we will always be dependent to some degree on global economic forces. China now drives the rest of the world in many respects,” Balmer said.

The IPO was an opportunity for Aston’s long-term backers — financial institutions from Italy and Kuwait — to realize some profits on their investments. The share sale raised no new money for expensive research and development, which some analysts criticized.

“There was no massive cash injection because all our new projects were already invested. And we’re making profits. But the IPO secures the long-term future of the company,” Balmer said.

In difficult global markets, the shares have been trading below the issue price since day one, but recently two big investment institutions — Merrill Lynch and Goldman Sachs — put them on the “buy” list. If they achieve sufficient value to be included in the main FTSE 100 list, Aston will be the first car company for 30 years to be on the UK’s main trading board.

That would be something of a triumph for Palmer and the second-century strategy, but Aston has another finishing line in sight before that: The Abu Dhabi Grand Prix. “We’ve got a number of things planned around the race, not least winning it,” Balmer said.